5 401k match calculator

0 4 10 3. What Happens if I Leave Before I Am Fully Vested in My 401k.

Here Is Where Your 401k Savings Vs Your Age Net Worth Good Work Ethic Personal Finance Blogs

Glassdoor is your resource for information about the 401K Plan benefits at Target.

. Deadlines for Contributing to Your S-Corp 401k 10. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. 0 4 10 0.

Access affordable 401k plans for small businesses with QuickBooks Payroll. The employer-matching funds will belong to you after five years at your job but if you leave your job after three years you will be 60 vested. One of the biggest perks of a 401k plan is that employers have the option to match your contributions to your account up to a certain point.

How To Calculate Required Minimum Distribution For An Ira. Simple 401k Calculator Terms Definitions 401k a tax-qualified defined-contribution pension account as defined in subsection 401k of the Internal Revenue Taxation Code. With a Safe Harbor Plan the employer can choose to contribute in one of three ways.

Average 401k Returns Dont Tell the Whole Story. You fund this account by contributing a set percentage of your paycheck into the account. However this number cant really tell you much.

With the employer match the balance would exceed six figures when the employee hit age 32 surpass a half million by age 46 and pass a cool million by age 53. Safe Harbor 401k Rules. Inflation the rate at which the general level of prices for goods and services is rising and subsequently purchasing power is falling.

The Thrift Savings Plan TSP was created by Congress in 1986 and is a tax-deferred retirement savings plan for federal employees. Pick the best retirement plan for your budget today. If you earn 50000 and you add your 5 to the plan thats 2500 youve put in.

A case could be made for. A 401k is an employer-sponsored tax-advantaged retirement plan. If you are receiving a match for example through an employer-based 401k it might be more attractive to pay into your retirement.

Similar to a 401k plan in the private sector the TSP allows employees to contribute a set dollar amount to the account every month. These accounts are 100 vested and must be funded on a per-pay-period basis. Step 5 Determine whether the contributions are made at the start or the end of the period.

A 401k match is money your employer contributes to your 401k. Your company might include a dollar for every dollar you put in your 401k plan until you reach a total of 5 of your before-tax pay for the year. Use the Additional Match fields if your employer offers a bi-level match such as 100 percent up to the first 3 percent of pay contributed and 50 percent of the next 2 percent of pay contributed.

Including 401k the employees share of the health insurance premium health savings account HSA deductions child support payments union and uniform dues etc. Then your employer will match 100also 2500. Maximize employer 401k matching.

Tax On A 401k Withdrawal After 65 Varies. If the percentage is too high contributions may reach the IRS. Step 6 Determine whether an employer is contributing to match the individuals contributionThat figure plus the value in step 1 will be the total contribution in the 401k Contribution account.

Dollar-for-dollar match up to 5. A safe harbor 401k plan will generally satisfy non-discrimination rules for both elective deferrals as well as employer matching contributions. Based on your inputs we also make suggestions on how to increase your investment savings.

For example if you start a 72t at the age of. With this key job benefit your employer adds to the money you save boosting your 401k account over the long term. By age 61 the balance would exceed.

Alternatives to Solo 401k. This calculator uses your input allocation percentages and rate-of-return for each to calculate a weighted-average rate-of-return for your net worth as it moves through the simulation. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Lets say you have a plan that increases the amount you are vested in your plan each year by 20this is known as graded vestingYou will be fully vested ie. You provide a mandatory match of 100 dollar for dollar on the first 3 of compensation contributed by employees plus a 50 match on the next 2 of compensation contributed by employees. Investment Calculator is a beautifully simple calculator to help you calculate the potential value of your retirement investments and visualize their growth.

Vanguards 2022 How America Saves report says the average 401k balance for Vanguard participants in 2021 was 141542 up 10 from the 2020 level. This amount automatically increases as the employees paycheck does. On your Form 1040.

The 72t rule is once completing a rollover and a 72t is setup to pay out an income stream it must continue until the age of 59 ½ has been reached or for a minimum of 5 years whichever comes last. You can contribute 25 percent of your income up to a total contribution of 54000. Whatever you take out of your 401k account is taxable income just as a regular paycheck would be when you contributed to the 401k your contributions were pre-tax and so you are taxed on withdrawals.

Step 7 Use the formula discussed above to calculate the maturity amount of the 401k. If your employer offers a 401k match invest everything you. Learn about Target 401K Plan including a description from the employer and comments and ratings provided anonymously by current and former Target employees.

Contribution Limits of an S-Corp 401k 7. Contribution percentages that are too low or too high may not take full advantage of employer matches. In this example you would enter 3 percent in the Match Up to field and 5 percent in the Additional Match Up to field to indicate the combined.

Make sure that you talk to your administrator if you are contemplating a plan amendment. Attract talent and match contributions so your team can grow with you. Solo 401k Calculator 9.

Currently 5 per month for QuickBooks Online Payroll Core users for the QuickBooks Workers Comp Payment Service. This debt repayment calculator figures how much faster you will get out of debt and how how much interest you will save by adding an additional principal repayment to your next regularly scheduled payment.

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Ultimate Retirement Calculator Our Debt Free Lives Retirement Calculator Retirement Calculator

401k Calculator For Excel 401k Calculator Savings Calculator Spreadsheet Template

Investment Goals Investing Investing For Retirement Retirement Savings Plan

Free Net Worth Calculator For Excel Personal Financial Statement Net Worth Welcome Words

Pin On Personal Finance

Retirement Planner Spreadsheet Retirement Planner Retirement Calculator Budget Spreadsheet

The Math Behind The Mortgage Refinance Mortgage Mortgage Tips Home Buying

Ira Financial Group Introduces Additional Features To Solo 401 K Annual Contri Refinance Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Traditional Vs Roth Ira Calculator Roth Ira Calculator Roth Ira Money Life Hacks

What Is A Roth Ira And Do You Really Need One Adopting A Lifestyle Roth Ira Investing Investing Money Roth Ira

Retirement Savings Spreadsheet Spreadsheet Savings Calculator Saving For Retirement

Use This Cagr Compound Annual Growth Rate Calculator To Work Out The Annual Growth Rate Square Footage Calculator Interest Calculator Square Foot Calculator

What If You Always Maxed Out Your 401k Money Saving Plan Financial Peace University Money Plan

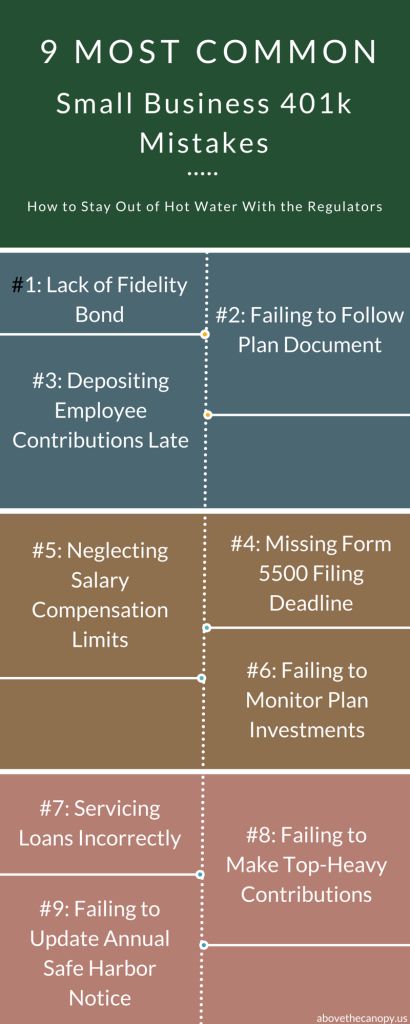

The 9 Most Common Small Business 401k Mistakes Above The Canopy Small Business 401k Small Business Resources 401k

Line Of Credit Tracker Line Of Credit Personal Financial Statement Student Loan Interest

Here Is What You Could Expect In Retirement If You Use A 401k Tsp 403b 457 Or Ira As Your Retirement Investment Investing For Retirement Investing Stock Market