23+ equifax mortgage score

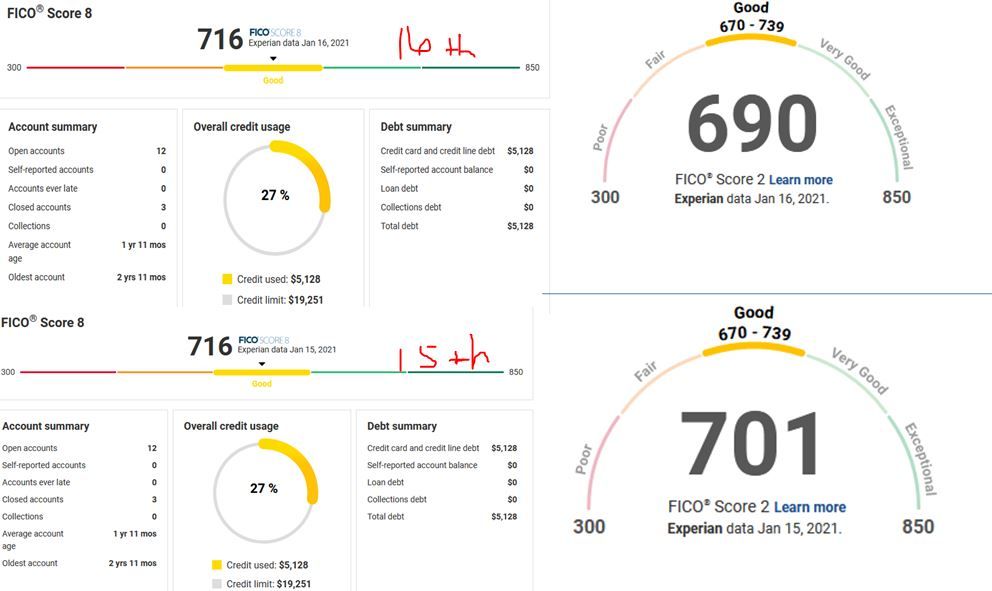

Experian is in the process of changing its scoring system. Web Although the simulators arent specific to mortgage they do help to determine ways to improve your score.

Which Fico Score Do Mortgage Lenders Use Credit Strong

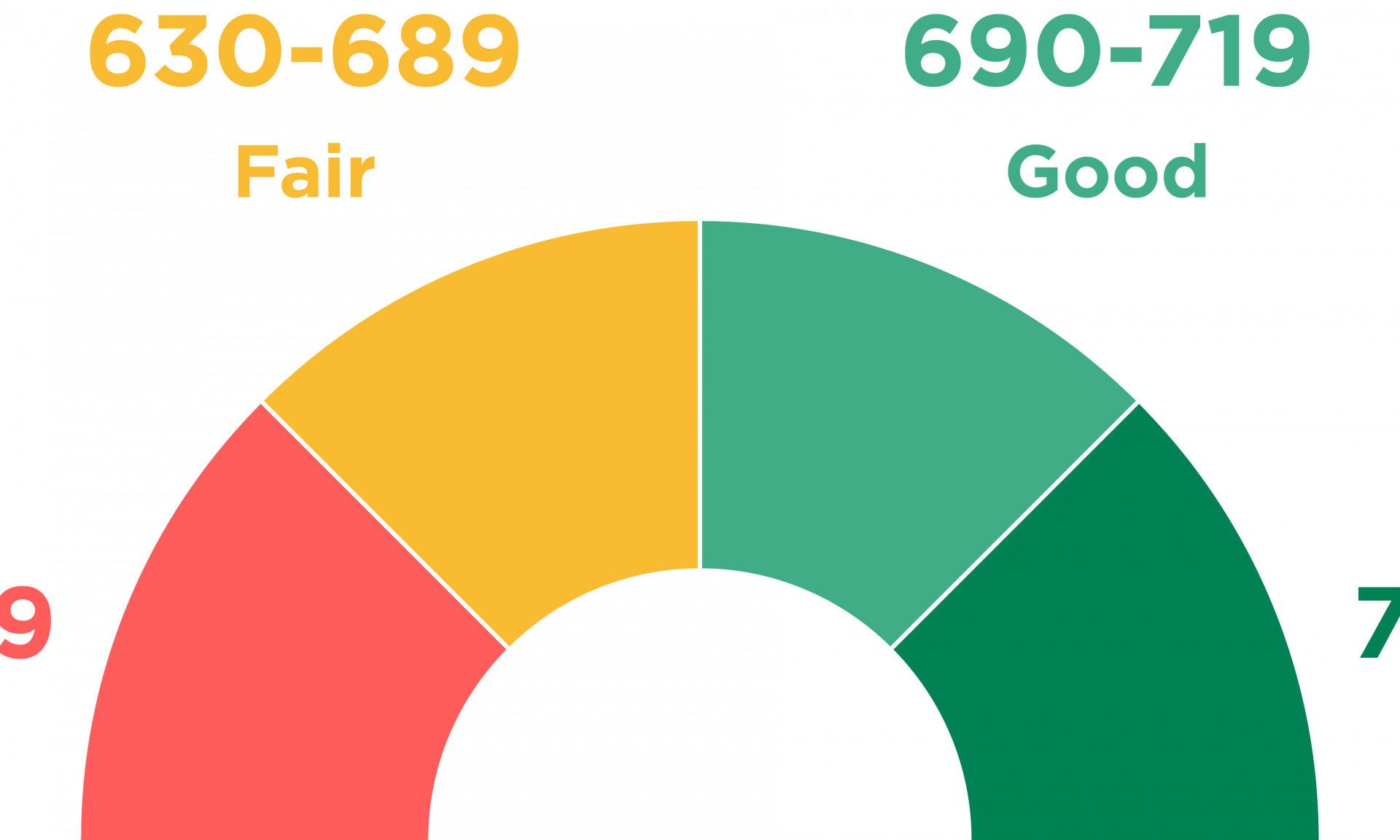

VantageScore a competing maker of credit scores also uses that range for its latest VantageScore 30 and 40 model credit scores.

. Original Mortgage maturity Sept 2044. Generally higher scores can mean a lower interest rate and vice versa. EX 751 EQ 720 TU 737 on 4914 Current Score.

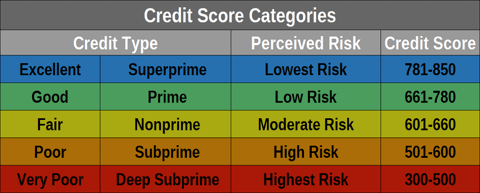

If you score between 961 and 999 youll rank excellent. Your lender or insurer may use a different FICO Score than the versions you receive from myFICO or another type of credit score altogether. Web Thats why lenders study the credit scores and credit reports of buyers before they approve them for mortgages.

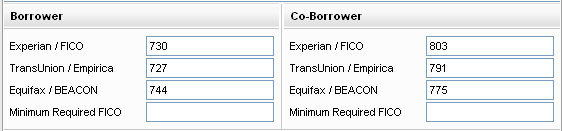

Experian TransUnion and Equifax. Web Here are the FICO scores used in credit reports generated by the three credit bureaus as well as the alternative names the bureaus use to advertise them. Web When a loan officer gets your mortgage application they may use a pricing grid to figure out how your credit scores affect your interest rate says Yves-Marc Courtines a chartered financial analyst with Boundless Advice.

Produce Quality Loan Files. EX 849 EQ 835 TU 843 Goal Score. Currently its score goes from 0 to 999.

Identify and Onboard New Borrowers Identify the Right Customers Target the right people the right way at the right time. Some mortgage lenders may have their own custom scoring models that factor the FICO mortgage scores into their overall formula. Due to COVID-19 we are experiencing longer than normal processing times.

Web Usually lenders will get one mortgage credit score from each of the three reporting agencies and use the median middle score as your credit score for qualification purposes. A mortgage lender on the other hand will review your credit information from all three of the primary credit reporting agencies. Web The credit scores provided are based on the VantageScore 30 model.

FICO Score 2 ExperianFair. This helps reduce the risk of passing out mortgage dollars. Web Solutions from Equifax can support you throughout the lending lifecycle.

Web Many mortgages require a down payment of at least 20 percent of the homes sale price. Web The FICO Score versions used in mortgage lending and the more recently released versions such as FICO Score 9 and 10 have the same 300 to 850 range. Web Equifax has recently updated its scoring range from 0 to 700 to 0 to 1000.

Refi maturity Dec 2030 Starting Score. 850 Take the myFICO Fitness Challenge Message 3 of 121 3 Kudos. Web According to FICO the current interest rate for a 30-year fixed mortgage is 2377 APR for a 760 borrower and 3966 for a borrower with a score between 620 and 639 which is considered.

Two of the most common are the FICO Score 5 and FICO Score 8. Youll definitely have a larger monthly. Web A credit card issuer or an auto lender will generally only check one of your credit reports and scores when you apply for financing.

If you have higher credit scores you may have some flexibility in how much you need to pay up front. Lenders use a variety of credit scores and are likely to use a credit score different from VantageScore 30 to assess your creditworthiness. Both are used by lenders to determine a prospective borrowers creditworthiness.

With a score above 620 you should have no problem getting credit-approved to buy a house. Generate Quality Leads Improve efficiency in finding and acquiring new customers. The average rate for a 15-year fixed mortgage is 633 which is an increase of 11 basis points compared to a week ago.

Both scores and reports tell lenders how well buyers have managed their credit and whether theyve paid their bills on time. Dispute Info on Your Credit Report Initiate an investigation if your Equifax credit report contains a potential inaccuracy. On the other hand lower credit scores may mean you must pay a.

Web 15-year fixed-rate mortgages. Web And even FICO scores come in different shapes and sizes. Web Get Your Free Credit Score and ReportLearn how to get your Equifax credit score and report for free from Equifax Canada.

To land an excellent score youll need 811 or more. Web If your credit score is above 580 youre in the realm of mortgage eligibility and homeownership.

What Goes Into Your Credit Score Theskimm

The Difference Between The Equifax Credit Score And The Fico Score

How Many Credit Scores Do You Have

Equifax Debtwise Review Moneyspot Org

What Is A Good Credit Score Why It Matters And How To Improve It

The Mortgage Porter Is 714 A Good Credit Score For Buying A House

Experian Mortgage Score Dropped For Now Reason Myfico Forums 6231362

What Is A Good Credit Score Equifax

Understanding Your Credit Score Part I West Financial Services

Credit Scores Used By Mortgage Lenders In Qualifying Borrowers

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

Credit Score Range And Scale In Mortgage Lending Part 1

Which Fico Score Do Mortgage Lenders Use Current Year Badcredit Org

Credit Score Information Guide To Credit Scores Equifax

Money Equifax Data Breach Reason For Bizarre Credit Score Declines

Which Fico Score Do Mortgage Lenders Use Current Year Badcredit Org

Check Experian Credit Score Get Free Credit Report Online In India Buddy Score